Availability Heuristic, What Is It And How To Avoid It

Previously I wrote about heuristics and biases, what they are and why they matter when it comes to finances. There are many different ones that have been recognized, and today I want to focus on availability heuristic.

Read on to find out what is it and how you might avoid it!

What is availability heuristic

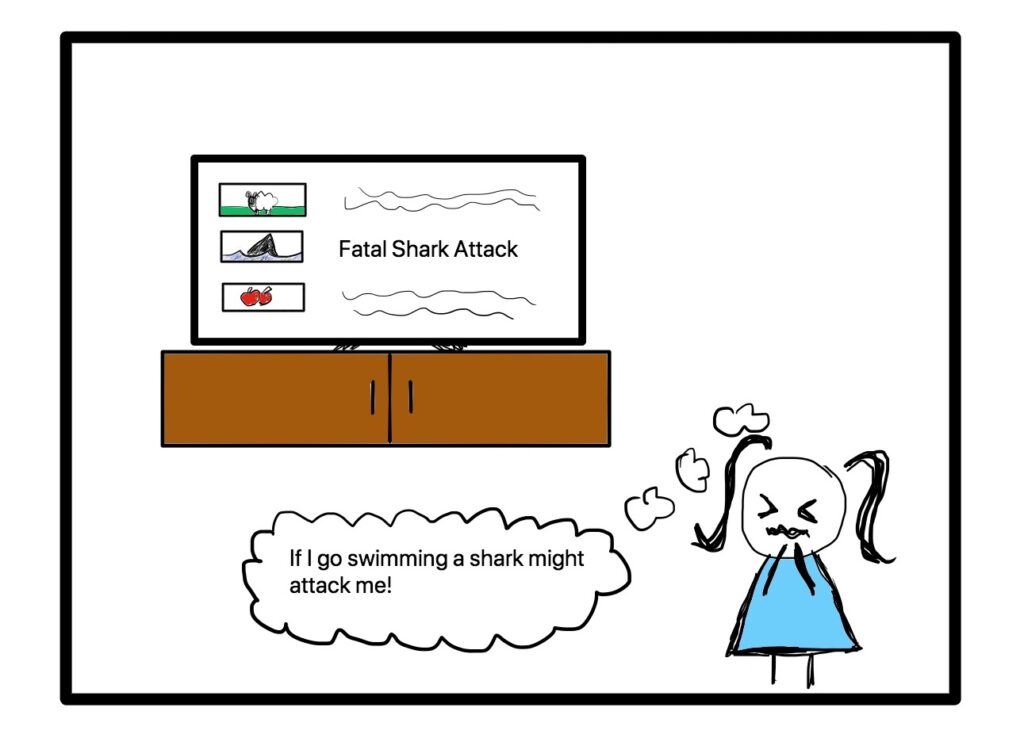

Availability heuristic is a shortcut to conclusions based on recent or most memorable information.

Basically, information that is at the forefront of your mind, or easily “available”, pops up without much effort.

Such information is then what gets used for decision making.

It is safe to say that this can affect the quality of the decisions you make, especially decisions relating to probabilities.

Why?

Because calculating proper probabilities most likely isn’t the easiest and quickest thing to do, so our brain tries to function efficiently and jumps to conclusions based on readily available information.

This could be news and other media coverage or some memorable events that may have triggered an emotional response.

For example, if you know someone who won the lottery you might spend a fortune on lottery tickets thinking that if they won, why wouldn’t you win eventually as well.

How does it relate to financial decision making

In financial decisions we rely on availability heuristic often because these decisions can get overwhelming with the vast amount of information available.

Especially investment decisions, which pretty much always involve probabilities.

So, our brain uses availability to reach conclusions quickly and with less effort.

For example, when it comes to big overall decisions around investments, seeing a lot of negative news coverage on investing in shares might make you reluctant to do so.

Or if you hear someone losing a lot of money investing in property (a flip gone wrong maybe), it could easily make you think twice before doing something like that yourself!

While these scenarios can of course happen (like a flip gone wrong), making a decision based on someone else’s experience is not very likely to represent the real probability of the same thing happening to you.

But that information is readily available to you as an example, so you might rely on that to make a decision.

Is there a way to avoid availability heuristic

Avoiding availability isn’t always easy, but it helps to be aware of it.

The most important thing is to do your own research before making big decisions.

When it comes to finances, run your own numbers and don’t make decisions based on what other people do or have done in the past, successfully or unsuccessfully.

Just because something worked, or didn’t work, for someone else doesn’t mean it applies to your sitution in the exact same way!

You can read more about availability heuristic here, and you can find my other heuristic and bias posts here.

Do you have an experience where availability has affected your decision making? I’d love to hear in the comments!