Benefits Of Dollar-Cost Averaging And What It Is

Have you heard of dollar-cost-averaging when it comes to investing? Do you know what it actually means and what are the main benefits of dollar-cost averaging?

What is dollar-cost averaging

Dollar-cost averaging is an investing strategy that is really easy to automate, kind of set and forget type of attitude.

It simply means that every week or month or quarter, however often you invest, you put your chosen sum of money on your investment account and invest it.

And you thought that investing strategies are complicated!

This strategy is used by most investors who use passive, buy and hold strategy when they invest.

They believe the trick to successful investing is not timing the market, but time in the market, and according a lot of research data to this, they are right pretty much most of the time.

If you try to time the market, you try to buy when prices are low and sell when prices are high. This is extremely difficult to do, even if you do it as your job because of the volatility of share prices!

Time in the market on the other hand just means that you buy a share and hold it, letting it grow in value over years and decades even, and don’t worry what the price is doing in the short term.

Main benefits of dollar-cost averaging

One of the benefits of automating your investing journey by regularly putting money towards your investments, essentially dollar-cost averaging, you can eliminate the human nature.

What do I mean by this?

If you automatically invest a certain amount at the same time every week, month or quarter, you take away the mental load of choosing when to invest, and therefore also eliminate the possibility of you being so indecisive that you won’t invest at all.

Automation also keeps you from looking at your portfolio, making it easier to stay the course and not worry about the dips in value, as you are less likely to even see it happen, compared to someone who checks their portfolio multiple times in a week, month or quarter.

But the main benefit of dollar-cost averaging is the fact that it evens out the price you pay for your investments, giving you a better average price per share over time.

The idea is that if you use a certain amount to buy shares every time, let’s say $50, there are times when the share prices are lower, which means that $50 buys more shares than when prices are higher.

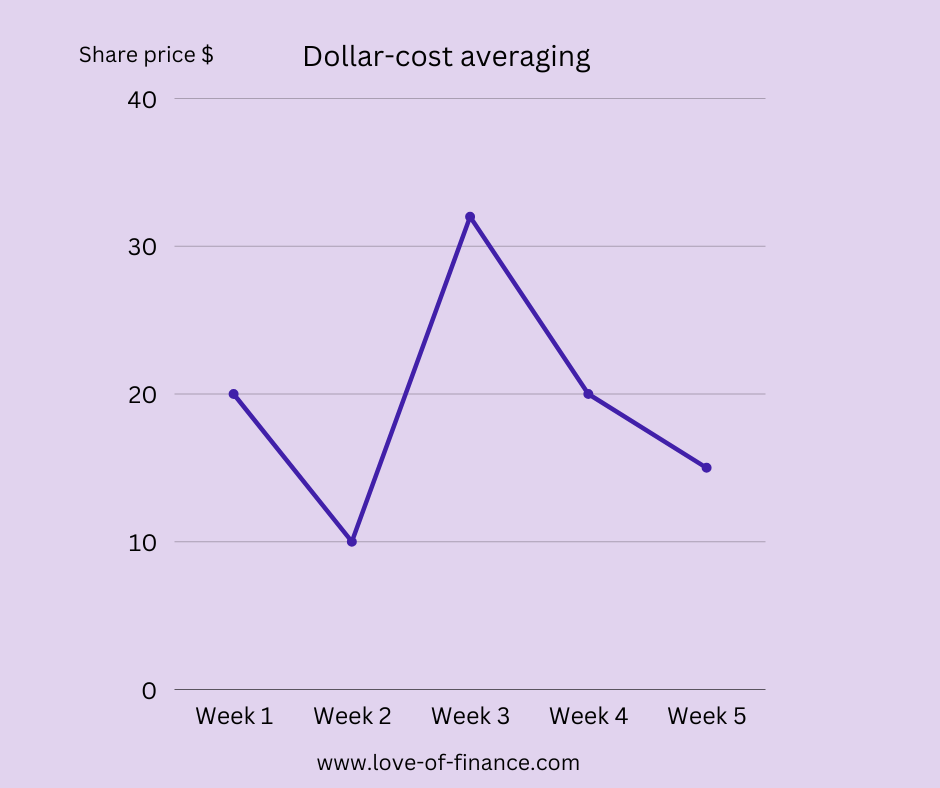

Dollar-cost averaging is easiest to understand if we use this simple graph. In this example I have a time span of five weeks, with the share price changing every week.

We will take two people, Mariah and Kate. Both have $250 to invest. Mariah decides to invest the $250 in one go on week 1. $250 will buy her 12.5 shares at the price of $20 per share ($250/$20=12.5).

Kate decides to spread the $250 over five weeks and invests $50 each week. On week 1 she buys 2.5 shares ($50/$20=2.5), week 2 she buys 5 shares ($50/$10=5), week 3 she buys 1.6 shares ($50/$32=1.56), week 4 she buys 2.5 shares ($50/$20=2.5) and week 5 she gets 3.3 shares ($50/$15=3.3).

At the end of week 5 Kate has ended up with 14.9 shares. Even though she invested the same dollar amount ($250) as Mariah, she ended up being able to buy more shares due to dollar-cost averaging.

The price of each share Mariah bought is $20 ($250/12.5=$20), but the average cost of Kate’s shares is only $16.80 ($250/14.9=$16.77).

This is the main and most powerful benefit of dollar-cost averaging.

You buy more when share prices are lower, less when they are higher, and end up with more shares in the end.

Since the average purchase price of your shares is lower, you will also enjoy higher capital gains.

For example, in Mariah’s case, the share price has to go over $20 for her to make a capital gain, Kate on the other hand makes a capital gain when the share price goes over $16.80.

So Kate will already have made capital gains when Mariah just breaks even.

KiwiSaver accounts are a great example of dollar-cost averaging, as you have very little control when your and your employer’s contributions are paid to your investment accounts.

Had you already heard of dollar-cost averaging? Would you consider using the strategy?