How To Use Savings Charts, And Why Do It

If you follow any social media accounts that are about budgeting, debt free journey or frugal living, you might have seen them using savings charts. But what are they, how to use them and why even bother?

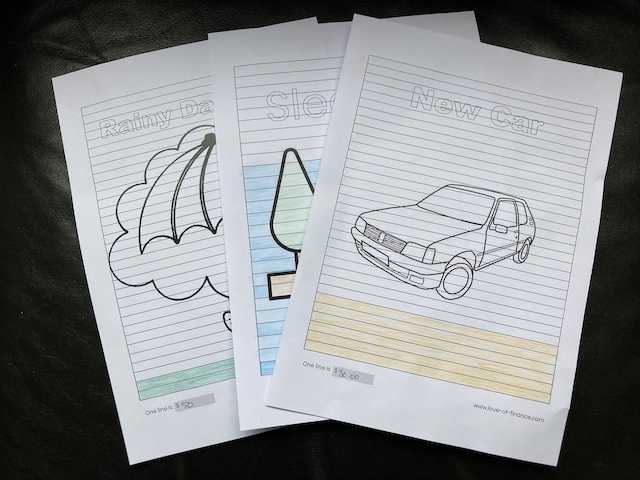

What are savings charts

Savings charts are basically colouring pages, the sections are often similar in size to symbolise the amount of money saved.

There are many designs out there, most common being an A4, with a big table of rows, a title to showcase what kind of savings the chart is for, and possibly a simple picture relating to the topic.

Others I’ve seen are for example a Tetris game, or other game type of layouts.

The main thing is that they all work the same way. They have areas that you colour in, these areas are same in size and when you start a chart, you choose what the value of each section is.

The point is to help you track your savings.

How to use savings charts

As mentioned above, each savings chart works pretty much the same way. Each section is worth the same amount of money.

For example, you start a savings chart and decide that each area you can colour in is worth $10. So every time you save $10, you get to colour in one section.

What if you decide that each section is worth $30, and one time you save $40? Well, you get to colour one section, and next time you transfer money into savings, you only need to transfer $20 in order to be able to colour in a section.

So, every time your savings have increased by the amount you assigned, you get to colour in a section.

But how do you choose how much each section should be worth?

Well, you can do what we did above and just choose a dollar amount. Then, at the end you will end up with your amount x how many sections there are in the savings chart.

The more common approach is to take your savings goal and divide it by the sections in your chart. This is now the amount each section is worth, and once the chart is fully coloured in, you will have your goal amount saved.

Let’s say that I want to save $1,500 towards my emergency fund and I use a savings chart to track it. My savings chart has 33 sections, so I divide $1,500 with 33, which is $45.45.

Now each time I have put $45.45 into my emergency fund I get to colour in a section, and by the time the chart is fully coloured, I have $1,500.

Savings charts can also be used as debt reduction trackers. The principle is the same, but your end goal is 0.

Why use them

The main benefits of savings charts are visibility and motivation.

It is recommended that they are kept in a visible spot, this will work as a reminder of your goal, making you more likely to reach it.

They are also a great visual representation of the progress you are making towards your goal. It is quite satisfying to see how the colouring page gets closer and closer to be finished.

Which brings me to motivation.

It can be very satisfying to get to colour in the section, getting closer and closer to finishing it. This can add extra motivation to reach your monetary goal as well.

Keeping the chart where you can see it and wanting to finish it will keep your savings goal at the fore front of your mind, which can help you reach it faster.

I personally really enjoy using savings charts and find it super satisfying being able to colour in the sections! I currently have savings charts for our sleep out savings, a new car savings and my emergency fund. You can read about my savings goals here.

Where to find savings charts

Savings charts are all over the internet.

Have good look though because some are free downloads and then there are ones that you need to purchase. Some might be free with another purchase.

I have created my own, which I will put available here when I figure out how! In the meantime feel free to message me and I will send them to your email.

Do you use savings charts? What do you think of them?