My Thoughts On The Finance And Investment Planner By The Curve

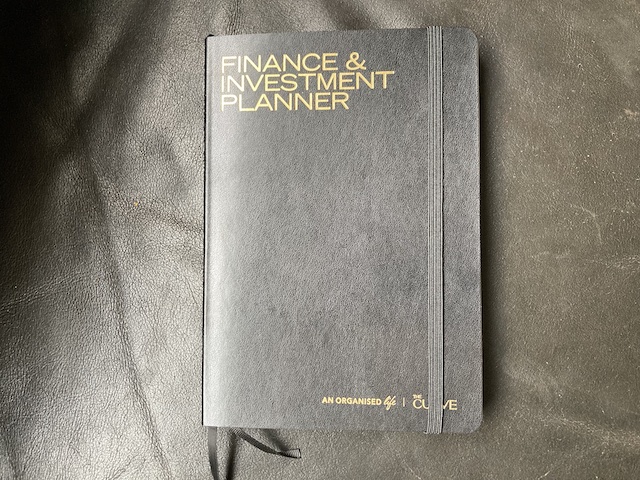

While reading the Informed Investor magazine a while back there was a mention of the Finance and Investment Planner designed by The Curve and An Organised Life. I decided to get it to see if it would help me streamline my investing strategy and I also wanted to share this tool on the blog as well.

What is The Curve

The Curve is an investing education platform, specifically for women.

They run a classroom to teach women about investing and finance, have a podcast and are active on social media.

They created the Finance and Investment Planner to help people start their investment journey.

What is in the Finance and Investment Planner

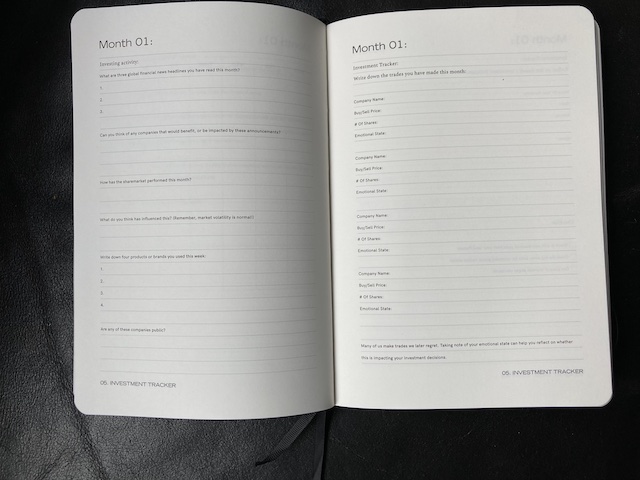

The Planner has 6 sections; Welcome, Investing, Budgeting & Financial Planning, Goal Planning, Investment Tracker and a lot of space for notes.

The Welcome section encourages you to think about your own relationship with money and family history related to money.

The Investing section has the basic information about what investing is and ideas how to choose what you might want to invest in. There is also discussion about investment horizon and risk profile.

The Budgeting & Financial Planning section has 12 months of budget trackers, and some pages for savings and retirement planning.

The Goal Planning section has space to write down short term, medium term and long term goals, and also to track those goals.

The Investment Tracker has a monthly sections for 12 months of tracking. Each month has it’s own investment related educational theme like dollar-cost-averaging or dividends. It allows you to track what you bought, and encourages you to keep an eye on the overall market.

My thoughts on the planner

I think this planner would be a great tool for investing, especially if you are a beginner and feeling overwhelmed with all the new information.

The planner is undated so there is no pressure to start in a certain month, you are able to decide it yourself.

I think it is great The Curve has taken a holistic view to investing, the planner is not just about buying shares but your overall finances, all the way to your money attitude.

I’m currently on my first month using the planner, I’ve filled out all the initial sections, except the Goal Planning one which I need to do, and wrote a new budget (I spoke about what lead to a new budget here).

I will be sharing my journey of using the planner alongside my monthly finance checks, as I use the planner to help track my budget and investing.

If you are feeling overwhelmed when it comes to starting investing, this could be a great tool with all the information it has in it, and with all the financial “prep work” it encourages you to do (setting a budget and goal planning for example).

I also like how compact and sleek the planner looks, it doesn’t take much space on my desk so it’s easy to keep handy!

(This is by the way not a sponsored or an affiliated post, I bought the planner with my own money and wanted to share for others as well.)

Would you give something like this a go? How do you track your investments?