November Finance Check: How My Money Kept Disappearing

Lately, my finances have been a bit all over the place, so I’ve decided to start some accountability for myself and share a monthly check in with my finances to hopefully keep better on track. So, here’s my November finance check!

Why my finances got so out of hand

Towards the end of the winter we started to get hit by sickness left, right and centre.

It got to a point where I could work one week, then not the next, with luck I could work the next two weeks and then again barely at all the one after.

I’m paid every two weeks, so I went quite a few paycheques with sometimes just half of my normal pay for two weeks.

But I kept spending like I had my usual amount of money!

I ended up draining my emergency fund, tapping into my sinking funds, taking some out from our joint accounts as well (after a discussion with my partner of course).

When I finally did get a good pay again, I was just trying to put back what I had spent, being no better off.

I realised I needed to re-evaluate my money situation, make a new budget, set some savings goals and try to stick to them again, rather than spend so much money on a whim.

So, I’m going to share those goals, my budget and actually track it for some accountability!

Finance check: Savings goals and progress

I have four main savings goals: emergency fund, sleep out, taking my girls to spend Christmas at home and going to Christchurch in a few weeks time.

Emergency fund

As I mentioned earlier I’ve managed to drain my emergency fund, couple of months ago it sat at about $1500.

I kept using it for various purchases and then when I needed to buy flight tickets to Christchurch, pay for some accomodation and a deposit on our rental car I took the money from the emergency fund instead of the dedicated savings account.

I initially thought that I would pay it back closer to the holiday, since the savings account has a higher interest rate.

But now I have decided that since I’ve reached my goal amount on the Christchurch trip account, instead of paying it back to the emergency fund, I will just save up a new emergency fund.

Currently I don’t have a set amount I put in here per week, will just transfer money in there whenever a $250 parcel is ready.

My emergency fund is with my main bank, BNZ, and since they fully stopped providing their low interest OnCall account, it now sits as a transaction account earning no interest. (I actually hadn’t realised this until I checked it to write this!)

So, I will be moving it to some other savings account in order to earn some interest, once I actually have money in it!

Sleep out

As I shared in this post, we are planning to build a sleep out and rent it out in order to save extra money to fully rebuild our house.

Our sleep out savings account currently sits at $6,849, which we are both very proud of. My initial target amount is $10,000, but I know it will most likely cost us $15,000-$20,000 to build.

The sleep out will be 30m2, one bedroom with kitchen and a bathroom. My partner will be building it so this will be the estimated cost of the materials to build and the fit-outs for the kitchen and bathroom, and also doors and windows.

We are hoping to start the build soon, and I will be tracking our spending carefully!

The sleep out savings live in our joint savings account at BNZ, which is their RapidSaver account with an interest rate of 2.7%.

Visiting family in Finland

The last time I went home was 2018 February. We were meant to go (and take my eldest) in 2020, but when we started looking at flights in March 2020, we all know what actually happened.

Lockdown. International travel restrictions.

Financially that was a blessing in disguise to me as I really couldn’t afford to get the flight tickets.

Anyway, I kept saving, small amounts but every week nonetheless. It is one of my non-negotiables.

Currently it sits at $2,973 and my goal is to have $10,000 for the trip. I really need to ramp up the savings in order to have enough by September 2023 to buy the tickets and then keep saving to have the rest by the time we fly in December.

I had originally thought we’d go during the Finnish summer 2024 but my passport is expiring before that and it is a pain to renew in New Zealand due to the fact that there is no embassy here.

So we’ll go for Christmas and I’ll renew my passport while I’m there!

Anyway, I want the trip to include a lot of cool activities and experiences for my partner and the kids, an AirBnB for 6 weeks, rental car and so forth. I also want to go to Iceland, without the kids.

So, I need to make a very rigorous savings plan for it.

These savings live in RaboBank’s 60 Day NoticeSaver account with an interest rate of 3.25%. The catch for the higher interest rate is of course the fact that I will need to wait 2 months for the funds after I request a withdrawal. But as this money is for a specific cause and I will know in advance when I need it, it’s okay.

Long weekend in Christchurch

It shocks people when I tell them that after living in New Zealand for 8 years I still have never been to the South Island.

Well, I’m finally going! This year I wanted to celebrate my birthday with a little long weekend family getaway, so we’re going to Christchurch, with a couple nights at Hanmer Springs.

I have reached the target amount I wanted to save for this trip, and I have already paid for the flights (about $600 for all 4 of us), 2 nights accomodation and spa in Hanmer Springs (about $550) and a deposit on our rental car (about $80).

I will be giving a more accurate breakdown of all the costs when we are back and I have all the numbers!

I’m very excited to go as one of my very good friends lives in Christchurch so I’m excited to see her and her daughter and spend time with them!

These savings live in RaboBank’s PremiumSaver account with the basic interest rate at 1.5%, but if you deposit at least $50/month you get a bonus bringing the interest rate to 3.10%.

Finance check: Investing

For this year my goal for investing was to invest $5,000. I’m currently at $4,775 invested this year, so doing great!

I also track dividends I receive, and so far this year I have been paid $82 in dividends.

Last year it was about $42 for the whole year, so more than doubled in one year, which is exciting!

I’m really interested to see how much it will for the whole year because last year December was my highest paid month.

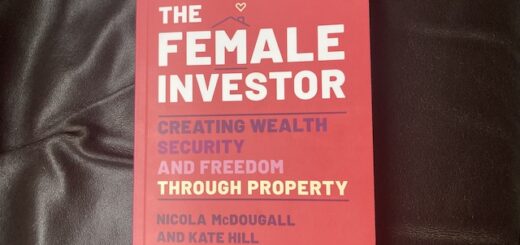

For the next 12 months I’m also going to try to streamline my investment strategy using the Finance and Investment Planner by The Curve. I’ll be sharing how that goes too! (I’m not affiliated with The Curve or the planner, I bought it myself to see if it will help me and to share my thoughts here in the blog!)

This is because my portfolio is a bit all over the show and I would like to maybe simplify it, or at least create a better investment strategy rather than my current, “uu, maybe I’ll buy some of that” strategy.

Which is ironic considering I study finance and know full well how to do an in-depth fundamental investment analysis, how to calculate intrinsic value of shares in multiple ways, how to use that information to make an investment choice and how to analyse and construct an optimal portfolio (in theory at least).

So maybe I should use that knowledge first on my own investment journey before I start doing it for others, right?

Currently I invest through Sharesies, Hatch and my KiwiSaver. Both Sharesies and Hatch are on the red but that doesn’t really worry me because I’m in this for the long run.

I still need to make a deliberate decision on where to have my KiwiSaver, currently it is still in a BNZ growth fund but mainly because I keep putting the decision making off.

What next

My focus for the rest of the year is to get a handle on my cashflow. Then make sure that my important savings goals are going to be reached on time. Optimising my investing will be my focus come 2023.

For now, I have used The Curve’s Finance and Investment Planner to create a new budget that takes into account all my expenses (as time went by I added new expenses but didn’t actually update them in the budget that I had in my head).

I’m already tracking all my spending, so it will be interesting to see how everything goes once I do a budget check at the start of December.

My previous personal finance Instagram account (that got hacked) revolved around my own financial journey and keeping accountable through the account, I’m looking forward to doing it again to some extent here and on my new Instagram account @love.of.finance !

How often do you check on your budget and investment strategy? I’d love to chat about it in the comments!