Number 1 Reason Why You Should Diversify Your Portfolio

Have you heard the saying “don’t put all your eggs in one basket”? Probably. Diversification is just a fancy way of saying the exact same thing. Here’s how it works, and why you should diversify your investment portfolio.

How do you diversify your investment portfolio

It might sound like it is a complicated thing to do, but in practice, it just means that you buy multiple different investments, rather than just one.

Bam, your portfolio is diversified, since you own more than just one investment.

Most investments, even within asset classes, are rarely exactly the same, they are heterogeneous.

This means each have their individual qualities which affect their return and risk profiles.

Let’s take property as an example.

Two properties are rarely identical, even if they are in the same apartment building. One apartment might be located in better height, or face the more desirable direction compared to another.

This means that one apartment might be valued more because of the individual attributes.

But at the same time, if your property portfolio only consists of apartments in the same building, your portfolio isn’t well diversified.

If something happened to the building, most likely both of your investments would be affected.

This is why better diversification would be to buy another apartment in another building, or different kind of property altogether, maybe even in a different city as well.

The same goes with company shares, no two companies are exactly the same.

But if you only buy New Zealand power company shares you are not very well diversified because all those companies would face similar challenges.

In order to diversify your portfolio well, it is recommended that you own 15-30 different companies’ shares. (The recommended amount depends on your source.)

These companies should be from different sectors of the economy (like health care, banking, electronics, etc.), so that even if one sector is hit badly for any reason, hopefully there is sectors that are still doing well, or at least not as bad.

Ideally, you should also own shares from outside of your own country, for the same reason.

The easiest way to diversify

Diversifying might sound hard work, and it could be. Or at least it requires a bit of research and having your thinking hat on.

So, is there are an easy way out?

There actually is.

There are many options out there where you buy a slice of a fund that invests in multiple things, therefore the fund is already diversified, ergo, your investment is diversified.

When you buy a share of a fund you will own a portion of everything that is in the fund, in the proportions that those investments are in the fund.

For example, a hypothetical fund invests in Air NewZealand (30%), Mercury (35%) and Fletcher Building (35%). If you buy into the fund with $50 your money will be split 30/35/35 between the three shares.

But. Not all funds are the same, there are a lot of different options out there, to the point where it really needs to be its own blog post.

That being said, funds are a great way to easily diversify your portfolio and get exposure to overseas sharemarkets as well.

Just make sure that you understand how the fund works. Like how to buy, how to sell, if there’s a minimum investment, the fees (very important) and past returns.

While you shouldn’t base your decision purely on past returns (it is NO guarantee of future performance), there might not be any point to invest in a fund that has been doing badly for a long time.

But why should you go through the trouble

Because diversification averages out the performances of your different investments. And this decreases the risk of your portfolio as a whole losing money.

As I’ve written before, the risk in investing in shares in particular is that they are volatile, their prices move up and down.

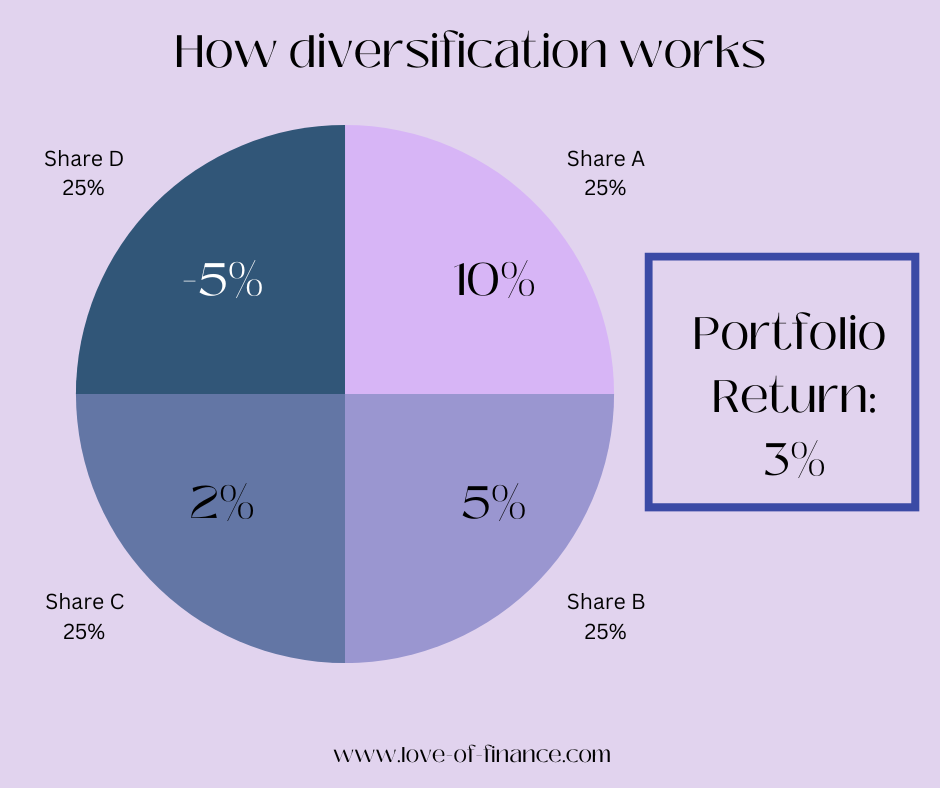

Let’s do a simple calculation to demonstrate: You have 4 different shares in your portfolio, A, B, C and D, in equal amounts (25% each).

Share A has grown 10% in value, B has grown 5%, C has grown 2%, but D has lost value and is down -5%.

Your portfolio return as a whole is the weighted average of these returns. This is calculated by multiplying the returns with the percentage that it represents in the portfolio and adding them all together.

Our example: 25% x 10% + 25% x 5% + 25% x 2% + 25% x -5% = 0.025 + 0.0125 + 0.005 + (-0.0125) = 0.03 = 3%

So, despite a quarter of your portfolio losing value, overall your portfolio would have made 3%.

This is why you should diversify.

If done well, it will help keep your portfolio overall on the positive, even if part of it is losing money.

How well is your portfolio diversified? Let me know in the comments!