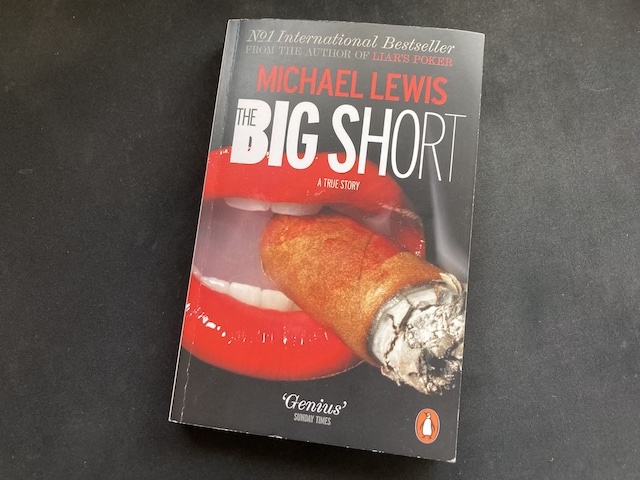

Review of The Big Short by Michael Lewis

Michael Lewis is an American author and financial journalist who shortly worked on Wall Street in the 1980s. His writings mainly cover financial crises and behavioural finance. Here I wanted to share my review of The Big Short, which takes us to find out what caused the Global Financial Crisis (GFC) of 2007-2009.

*Disclaimer: This post will include an affiliate link. If you choose to click through and make a purchase, I will receive a small commission, at a no cost to you! If you’d like to support my blog by using the link, thank you!

What was the Global Financial Crisis about

If you were too young to remember what the financial crisis was, or didn’t really pay attention to it too much, here is a quick recap.

In 2007 the housing market bubble in the USA started to show signs of popping.

The house price growth was slowing down, making it harder for people to refinance their homes at better interest rates.

This resulted in people starting to default in their mortgage payments at increasing rates.

Now financial institutions (the likes of banks and other lending companies) have created financial securities (= something that makes them money) that are based on mortgages.

Usually mortgages are a relatively safe base as interest rates on mortgages are relatively low and a home is such an important asset to people that they often do what it takes to keep paying their mortgage.

Long story short, the financial securities fully lost their value as the mortgages they were based on defaulted.

This then meant that the banks and other institutions, in the USA and globally, lost billions dollars if they had invested into these securities.

Now, even if you’re a big bank in the USA, losing billions of dollars isn’t good. One was saved from going under by the US government (Bear Stearns) and the other went under (Lehman Brothers).

This is something that people didn’t believe could ever happen, but it did.

And The Big Short explains why.

The Big Short in a few words

The Big Short is a true story and introduces a handful of real people who saw the housing market collapse coming, and who also made money as a result.

These were Michael Burry, Steve Eisman, Greg Lippmann, Charlie Ledley, James Mai and Ben Hockett.

The book tells the background of each of these men and how they became aware of the bad mortgages and the financial securities related to them.

Michael Lewis goes into great depth to describe these men and tells their stories like he was present when these events were happening.

My review of The Big Short

While I enjoyed this book very much, I have to say it wasn’t the easiest to read. Which is understandable considering the complex subject of institutional investing.

(Institutional investing is investing done by big banks, big retirement funds, managed funds and hedge funds for example, so not by people like you and me.)

The stories of these men were quite interesting and inspiring in the sense that how it is possible to spot opportunities.

The book also shows the dark side of the banking industry and what’s wrong with it and Wall Street. And I think it’s good to be aware of that.

The main lingering feeling for me after reading the book was the anger at how unfairly Michael Burry got treated by his investors. (Michael Burry ran a hedge fund and was the first one to spot the investment opportunity).

Even after being proven right and making his investors crazy profits, he was treated with mistrust and like he was incapable of managing their money.

I can only imagine how frustrating that would have been for him considering nobody had any real reason to not trust him to make good investment decisions which he based on his research.

Long story short, my end review of The Big Short is that it was definitely worth the read.

If you’re interested at all on the background of the GFC I would definitely recommend this book! While it does have a bit of jargon in it, the main terms that you need to know are explained.

You can get your own copy here if you’re based in NZ or here if you’re anywhere else.

And more ideas on what to read here.

People hate to think about bad things happening, so they always underestimate their likelihood.

written by Michael lewis, words by Charlie LEdley

A quick review of The Big Short movie

The Big Short has been adapted into a movie with a cast including Steve Carell, Ryan Gosling, Christian Bale and Brad Pitt.

While it is based on the book and follows it for the most part, some creative changes have been made.

All in all it is a great movie which I really enjoy and have watched twice. I especially enjoyed Steve Carell’s and Christian Bale’s performances as Mark Baum (character based on Steve Eisman) and Michael Burry, respectively.

I find the movie entertaining, and it also explains financial concepts well in a way that it’s easy to understand.

If you’re not big on reading but interested in the story and the background of the financial crisis, I definitely recommend this movie! At the time of writing The Big Short movie is available Disney+ in New Zealand.

Have you read the book or watched the movie? What did you think of it? I’d love to hear in the comments!