Rich Dad, Poor Dad by Robert Kiyosaki

Rich Dad, Poor Dad is a book by Robert Kiyosaki who is an American business man and an author.

His business and books focus on financial education and he has sold millions of books. His main mission is to “wake people up” and help them get out of the “rat race”. “Rat race” being the usual life of working for money.

Robert Kiyosaki advocates for passive income streams, investing and learning. Robert Kiyosaki is one of the big names in the personal finance sphere and a name that is bound to pop up!

*Disclaimer: This post will include an affiliate link. If you choose to click through and make a purchase, I will receive a small commission, at a no cost to you! If you’d like to support my blog by using the link, thank you!

Why is Rich Dad, Poor Dad such a big deal

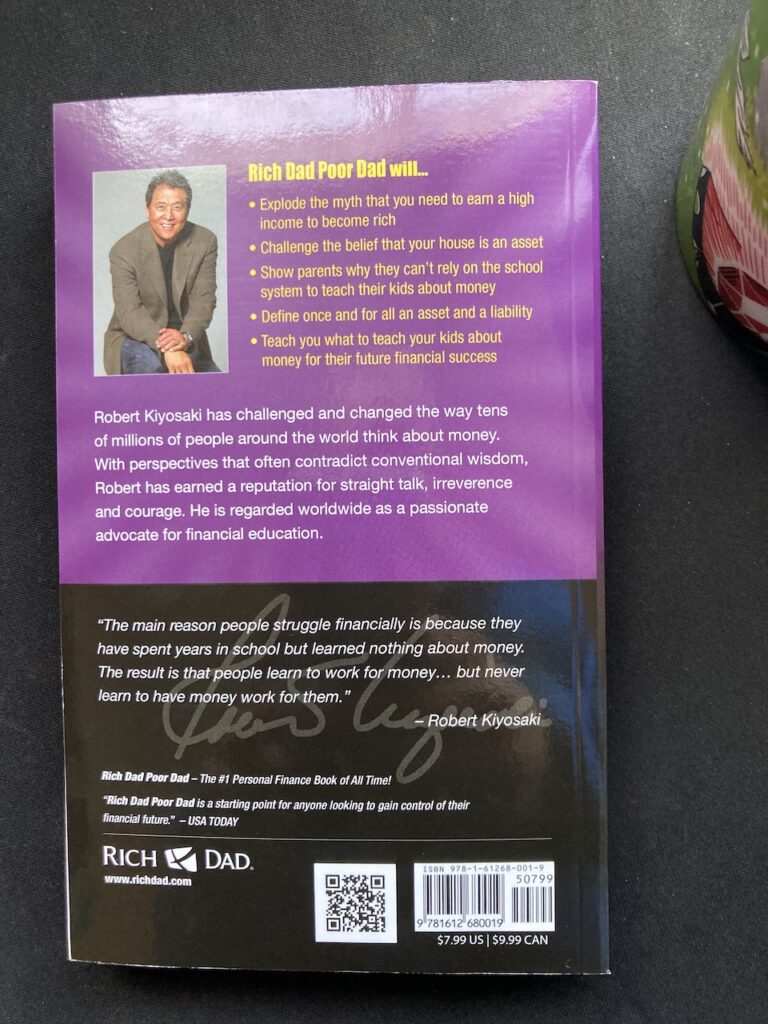

Rich Dad, Poor Dad is a classic personal finance book that is pretty much one of the corner stones of the FIRE (Financial Independence, Retire Early) movement.

The book tells the story of Robert Kiyosaki (the author) starting from childhood. He tells how what he learned about money from his own father (the poor dad) and from his friend’s father (the rich dad) helped him become wealthy.

Kiyosaki’s poor dad was an academic, working for the state and not interested in money management. His rich dad was an entrepreneur who taught Kiyosaki how to invest and how money can earn money too.

The book was first published in 1997 and while it is getting old, the principles discussed in the book are still applicable.

In the book you can find chapters titled such as:

- The Rich Don’t Work For Money

- The Rich Invent Money

- Work To Learn – Don’t Work For Money

- … and more

My thoughts on the book

I’ll be completely honest and say that I’m not a big fan of Rich Dad, Poor Dad (or Robert Kiyosaki himself for that matter).

Despite the book being a classic and a lot of people rave it having been a game changer, it is far from being a literal master piece. Very repetitive to read and I find him a bit arrogant.

I mean, he had a great head start to his financial journey with a great role model and he grew up in a time where things weren’t as expensive yet.

If you haven’t read the book, he actually bought his first property by putting the deposit on a credit card. Yup, those are some different times compared to today!

The success of the book is not too much of a wonder though, Robert Kiyosaki is a great salesman after all. The book isn’t all bad though, and does what Kiyosaki set out to do. To wake you up and to realise the possibilities.

I think especially his assets vs. liabilities conversation is great and important for everybody to understand. He also advocates learning (and we’re not talking about academic degrees here), which is awesome and important when it comes to life in general.

One thing that really sets him apart from the other finance “gurus” out there is how vocal he is about gearing (= using debt to invest). Although he is against debts that just cost you, he is big on using debt to make more money, which can be risky (but pretty much the way to go when it comes to property investing).

A person can be highly educated, professionally successful, and financially illiterate.

Robert Kiyosaki

To summarise, even though I’m not the biggest fan of the book, I think it has good points and there is a reason why it is such a classic. So if you haven’t read it yet, you might want to give it a go!

You can get a copy of the book *here for NZ shoppers and *here for international.

For more book ideas on what to read next, check my reading list!

Have you read Rich Dad, Poor Dad? What did you think? I’d love to hear in the comments!