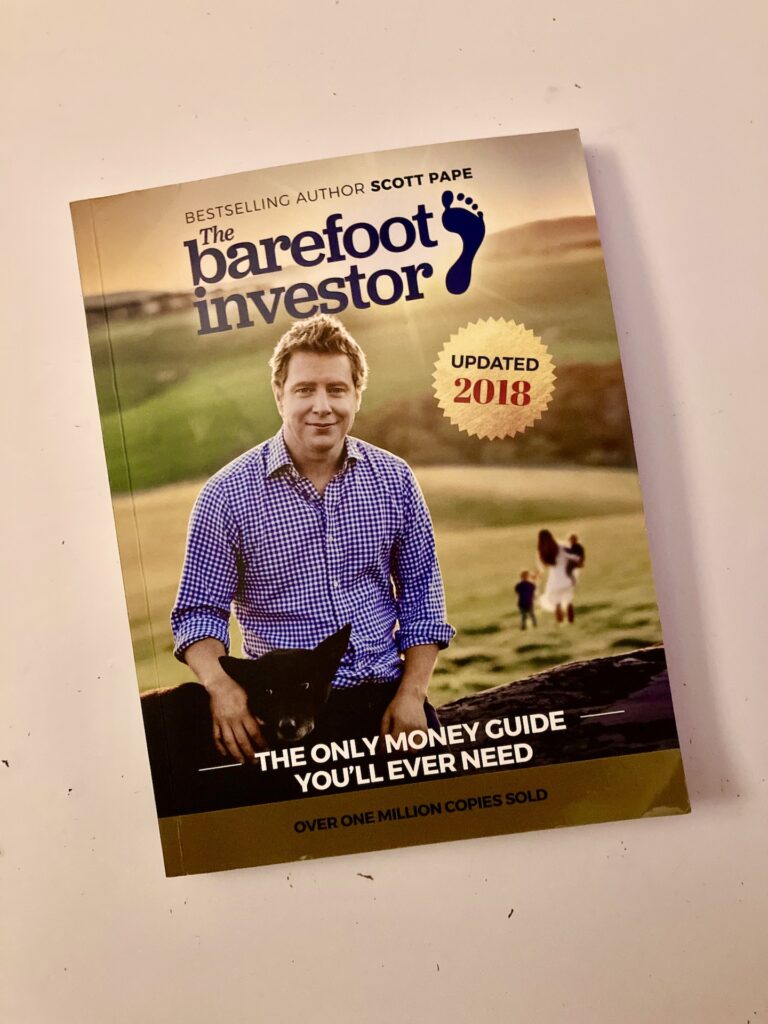

The Barefoot Investor by Scott Pape

There are a few, hmm, gurus so to speak in the personal finance sphere, and Scott Pape (or the “BI” aka the Barefoot Investor) is one of them.

He is an Australian who currently works as a not-for-profit financial counsellor and has written The Barefoot Investor and The Barefoot Investor For Families, which have been bestsellers. The version I’ve read is the 2018 revised version, there is a more of an up-to-date version available as well.

*Disclaimer: This post will include an affiliate link. If you choose to click through and make a purchase, I will receive a small commission, at a no cost to you! If you’d like to support my blog by using the link, thank you!

What you can expect from The Barefoot Investor

The Barefoot Investor aims to give you a step-by-step plan on how to take control of your finances and help you to know how to keep your finances in order for the rest of your life.

The Barefoot Investor’s core method is so called “Barefoot Date Night”, where once a month you sit down with your significant other (and if you’re single, you’re encouraged to have an accountability buddy) and go through one actionable step during each date night. The steps include:

- Setting up bank accounts

- How to figure out how much to save and how much to spend

- Sorting out debt

- Setting up insurance

- … and more

As often with personal finance books, there are chapters talking about retirement saving but they are Australia specific.

My thoughts on the book

I find The Barefoot Investor quite an enjoyable read.

It is down to earth, written with some humour which makes it an easy read, even if finance isn’t your thing. The advise in the book is general enough to suit most people starting on their journey to control their money, but at the same time specific enough, making the steps actionable and easy to follow.

When I say specific, I mean there’s actual bank recommendations with what kind and how many accounts to open etc. While this makes things easy for Aussie readers, it will be harder for others to follow the Barefoot style to the dot, and will require your own research.

The general suggestions (like opening a low fee accounts for example) should be applicable everywhere though.

My favourite parts are the idea of date nights, talking about finances with your significant other to make sure you’re on the same page, and I also like the buckets (general percentages of how much of your income would ideally go and where).

You and I are going to plant your wealth tree, and get it growing.

Scott Pape

I would definitely recommend reading this, even if you’re not living in Australia.

While I’m sure internet is full of disagreements over which financial guru has it right, I think it’s beneficial to read about different ways of managing money, and then incorporate whatever might work for you, in that time in your life!

You can order your own copy through *here for NZ shoppers and *here for international. And you can find a list of other book reviews I’ve shared here.

Have you read The Barefoot Investor? What was your takeaway? I would love to hear in the comments!