What Is Inflation And Why It Matters

Inflation and the rising cost of living are currently the biggest financial concern for many Kiwis. But what is inflation, why does it exist and why does it even matter? Let me explain!

What is inflation and why it exists

Inflation isn’t a new phenomenon, it has just recently made headlines because it has been rising relatively suddenly.

Inflation simply put is the phenomenon where prices go up over time, or alternatively, when money loses value overtime.

A dollar won’t buy you as much today as it did 10 year ago, and 10 years from now it won’t buy as much as it does today.

Inflation is a by-product of a growing economy, it is a cycle of rising income level that leads to increased consumption, which leads to higher demand and prices, and on and on it goes.

This is why governments (New Zealand included) globally aim to keep inflation going, at about 2-3% usually.

The Reserve Bank of New Zealand is responsible for monetary policy in New Zealand, which is the measures taken to try and control inflation.

Looking back

As mentioned above, inflation is not new.

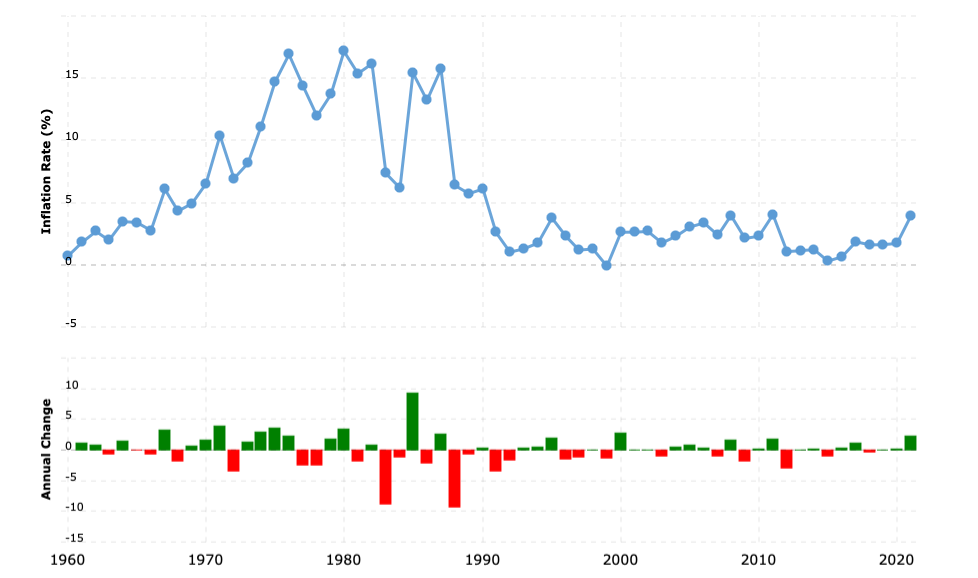

Below is a chart showing the rate of inflation in New Zealand from 1960 to 2021 (the blue dotted line showing the rate).

As you can see, since the 1990s New Zealand has had low inflation, not peaking above 5% until now (late 2022, early 2023).

Whereas in the late 1970s and 1980s inflation was significantly higher, peaking above 15%. That is over double what we are experiencing now.

Now I’m not sharing this to minimise the struggle the high inflation and cost of living crisis is putting people through now.

I’m sharing this to give perspective, to show that inflation has gotten high before, but has also come back down.

Types of inflation

Inflation is a complex topic and a lot of things play a part in inflation rates.

However, there are 3 main drivers, or causes, for inflation, which I go through quickly below.

Demand driven

Demand driven inflation happens when the overall demand for goods and services surpasses the overall supply for goods and services.

This means more people want to buy things, but there isn’t enough to go around.

Many factors will push the price up from this point forward.

Suppliers will try to meet the demand by producing more product, this can mean hiring more staff (possibly with increased wages) which will increase the expenses for the company, increasing prices.

If people’s income goes up, they will be able to spend more money, increasing demand and on and on it goes.

Supply driven

Supply driven inflation happens when there are some kind of restrictions to suppliers ability to produce goods and/or services.

Demand stays the same but the amount available is lower or costs more for other reasons.

This could mean problems being able to bring product to the country from somewhere else, meaning there is less available.

Or for example if a supplier is facing higher expenses, this could be passed down to the end buyer in the form of higher cost of products.

Expectations

Might sound funny, but the mere expectation that inflation is rising can cause the inflation to rise.

If you think the prices will be rising in the future, you will try to make your purchases now, while the prices are still lower.

This will increase demand now, and cause rising prices (as mentioned above in demand driven inflation).

Once inflation is high, people will stop spending money due to the higher cost of things, meaning and less demand, which can calm the inflation and bring it down.

Methods governments use to control it

Governments aim to control the inflation with monetary policy tools.

The most common tools that the New Zealand Government uses are official cash rate (OCR) and forward guidance. There are others as well, and you can read about them on the Reserve Bank of New Zealand website.

OCR controls the cost of money. It affects overall interest rates, making lending money more expensive overall.

The point of this is to reduce demand, and the reduced demand is meant to drag down inflation with it.

Forward guidance on the other hand is managing expectations. This is done by the Reserve Bank of New Zealand announcing what they are going to do with the OCR.

Are they going to raise it in the future? Reduce it in the future? Keep it the same for an X period of time?

The expectation of the movements in OCR will affect the economy even before the OCR moves anywhere.

These methods in theory work better with demand driven inflation, as supply driven inflation has often reasons beyond the influence of these policy tools.

Why is inflation important in personal finance

While the reasons behind inflation are complex, the impact it has on personal finance is quite clear.

Inflation simply needs to always be taken into consideration when making financial decisions, especially around investments and how much you are holding in savings accounts.

As mentioned previously, inflation erodes the value of money over time, so it needs to be taken into account when for example considering calculations for needs in retirement.

It is also important to consider investment returns with inflation in mind. For example if an investment returns 4% per year but inflation is 5% that year, despite the 4% return, your money has lost 1% of its purchasing power.

These are especially important consideration when we are trying to preserve the value of our money over a longer period of time.

This is also why you can’t really save your way to a comfortable retirement.

The point of this post was to help you understand what inflation is and give some historical context to help ease your mind about the future. It’s hard right now. And while I don’t know the future, I have faith that eventually it will get better again.

While it won’t fix everything, good money management will help you manage the stress caused by high inflation. Here I share three different ways you could manage money that will hopefully help.

How are you managing in this high inflationary time?